Cashflow 101 202 Excel Spreadsheets Downloads

Posted By admin On 11.10.19

Return on average capital employed (1) (percent) 3.9 7.9 16.2 17.2 25.4 Earnings to average ExxonMobil share of equity (percent) 4.6 9.4 18.7 19.2 28.0 Debt to capital (2) (percent) 19.7 18.0 13.9 11.2 6.3 Net debt to capital (3) (percent) 18.4 16.5 11.9 9.1 1.2 Current assets to current liabilities (times) 0.87 0.79 0.82 0.83 1.01 Fixed-charge coverage (times) 5.7 17.6 46.9 55.7 62.4 (1) See Frequently Used Terms on pages 90 through 93 of ExxonMobil's 2016 Financial & Operating Review. (2) Debt includes short-term and long-term debt. Capital includes short-term and long-term debt and total equity. (3) Debt net of cash and cash equivalents, excluding restricted cash. 2016 2015 2014 2013 2012.

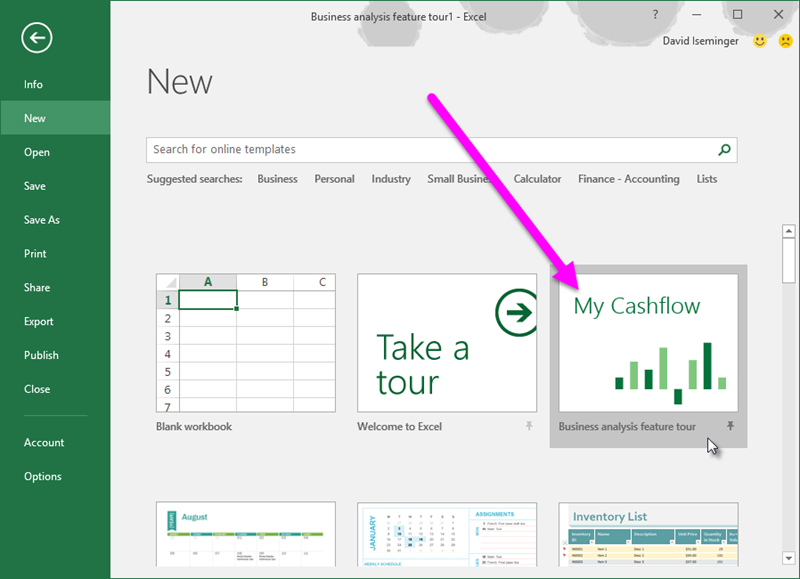

Vintage CashFlow 101 & 202 Excel Spreadsheets Rich Dad Kiyosaki for sale. Cashflow Excel Spreadsheet Cashflow 101. Cashflow Excel Spreadsheet. (Log in or Register to download.).

(millions of dollars) Earnings (U.S. GAAP) Upstream United States (832) (514) (477) (2,328) (4,151) (1,079) 5,197 4,191 3,925 Non-U.S. 756 808 1,097 1,686 4,347 8,180 22,351 22,650 25,970 Total (76) 294 620 (642) 196 7,101 27,548 26,841 29,895 Downstream United States 187 412 225 270 1,094 1,901 1,618 2,199 3,575 Non-U.S. 719 413 1,004 971 3,107 4,656 1,427 1,250 9,615 Total 906 825 1,229 1,241 4,201 6,557 3,045 3,449 13,190 Chemical United States 581 509 434 352 1,876 2,386 2,804 2,755 2,220 Non-U.S.

774 708 737 520 2,739 2,032 1,511 1,073 1,678 Total 1,355 1,217 1,171 872 4,615 4,418 4,315 3,828 3,898 Corporate and Financing (375) (636) (370) 209 (1,172) (1,926) (2,388) (1,538) (2,103) Net income attributable to ExxonMobil (U.S. GAAP) 1,810 1,700 2,650 1,680 7,840 16,150 32,520 32,580 44,880 (1) Net income attributable to ExxonMobil (U.S.

GAAP) corresponds to the Summary Statement of Income on page 87 of ExxonMobil's 2016 Financial & Operating Review. Unless indicated, references to earnings and Upstream, Downstream, Chemical, and Corporate and Financing segment earnings are ExxonMobil's share after excluding amounts attributable to noncontrolling interests.

2016 2015 2014 2013 2012. (millions of dollars) Upstream United States 62,114 64,086 62,403 59,898 57,631 Non-U.S. 107,941 105,868 102,562 93,071 81,811 Total 170,055 169,954 164,965 152,969 139,442 Downstream United States 7,573 7,497 6,070 4,757 4,630 Non-U.S. 14,231 15,756 17,907 19,673 19,401 Total 21,804 23,253 23,977 24,430 24,031 Chemical United States 9,018 7,696 6,121 4,872 4,671 Non-U.S. 15,826 16,054 16,076 15,793 15,477 Total 24,844 23,750 22,197 20,665 20,148 Corporate and Financing (4,477) (8,202) (8,029) (6,489) (4,527) Corporate total 212,226 208,755 203,110 191,575 179,094 Average capital employed applicable to equity companies included above 34,190 34,248 35,403 35,234 32,962 (1) Average capital employed is the average of beginning-of-year and end-of-year business segment capital employed, including ExxonMobil's share of amounts applicable to equity companies. (2) See Frequently Used Terms on pages 90 through 93 of ExxonMobil's 2016 Financial & Operating Review.

2016 2015 2014 2013 2012. (percent) Upstream United States (6.7) (1.7) 8.3 7.0 6.8 Non-U.S. 4.0 7.7 21.8 24.3 31.7 Total 0.1 4.2 16.7 17.5 21.4 Downstream United States 14.4 25.4 26.7 46.2 77.2 Non-U.S. 21.8 29.6 8.0 6.4 49.6 Total 19.3 28.2 12.7 14.1 54.9 Chemical United States 20.8 31.0 45.8 56.5 47.5 Non-U.S. 17.3 12.7 9.4 6.8 10.8 Total 18.6 18.6 19.4 18.5 19.3 Corporate and Financing N.A. Corporate total 3.9 7.9 16.2 17.2 25.4 (1) See Frequently Used Terms on pages 90 through 93 of ExxonMobil's 2016 Financial & Operating Review. 2016 2015 2014 2013 2012.

(millions of dollars) Upstream Exploration United States 252 491 448 1,032 2,386 Non-U.S. 1,574 2,189 3,241 6,123 2,354 Total 1,826 2,680 3,689 7,155 4,740 Production (2) United States 3,266 7,331 8,953 8,113 8,694 Non-U.S. 9,450 15,396 20,085 22,826 22,395 Total 12,716 22,727 29,038 30,939 31,089 Power United States – – – – – Non-U.S. – – – 137 255 Total – – – 137 255 Total Upstream 14,542 25,407 32,727 38,231 36,084 Downstream Refining United States 675 830 967 651 482 Non-U.S. 1,337 1,153 1,042 1,046 1,233 Total 2,012 1,983 2,009 1,697 1,715 Marketing United States 27 142 285 159 118 Non-U.S.

286 421 682 413 385 Total 313 563 967 572 503 Pipeline/Marine United States 137 67 58 141 34 Non-U.S. – – – 3 10 Total 137 67 58 144 44 Total Downstream 2,462 2,613 3,034 2,413 2,262 Chemical United States 1,553 1,945 1,690 963 408 Non-U.S 654 898 1,051 869 1,010 Total Chemical 2,207 2,843 2,741 1,832 1,418 Other United States 93 188 35 13 35 Non-U.S. – – – – – Total other 93 188 35 13 35 Total capital and exploration expenditures 19,304 31,051 38,537 42,489 39,799 (1) See Frequently Used Terms on pages 90 through 93 of ExxonMobil's 2016 Financial & Operating Review. (2) Including related transportation. 2016 2015 2014 2013 2012. (millions of dollars) Consolidated Companies' Expenditures Capital expenditures 16,009 27,610 33,056 36,862 35,375 Exploration costs charged to expense United States 220 182 230 395 392 Non-U.S.

Jan 17, 2018 - Listen: While hip hop artist El-P is still progressing his craft as a producer on his latest studio album, some of his hooks and more conceptual. El-p cancer for cure. Feb 1, 2018 - Listen: While hip hop artist El-P is still progressing his craft as a producer on his latest studio album, some of his hooks and more conceptual. El P Cancer For Cure Rar 320 Area Cpde ATTENTION: The mathematical examples on this page describe how margin works. How can I determine if I am going.

(millions of dollars) Upstream United States 78,294 85,070 83,456 80,176 78,352 Non-U.S. 117,610 118,752 121,852 117,378 103,443 Total 195,904 203,822 205,308 197,554 181,795 Downstream United States 9,662 9,879 10,314 9,955 9,119 Non-U.S. 10,926 11,451 12,325 13,264 13,934 Total 20,588 21,330 22,639 23,219 23,053 Chemical United States 8,070 6,855 5,345 4,179 3,846 Non-U.S. 9,331 9,392 9,573 9,786 10,239 Total 17,401 16,247 14,918 13,965 14,085 Other 10,331 10,206 9,803 8,912 8,016 Total net investment 244,224 251,605 252,668 243,650 226,949 2016 2015 2014 2013 2012.

(millions of dollars) Upstream United States 9,626 5,301 5,139 5,170 5,104 Non-U.S. 9,550 9,227 8,523 8,277 7,340 Total 19,176 14,528 13,662 13,447 12,444 Downstream United States 628 664 654 633 594 Non-U.S. 889 1,003 1,228 1,390 1,280 Total 1,517 1,667 1,882 2,023 1,874 Chemical United States 275 375 370 378 376 Non-U.S.

477 654 645 632 508 Total 752 1,029 1,015 1,010 884 Other 863 824 738 702 686 Total depreciation and depletion expenses 22,308 18,048 17,297 17,182 15,888 2016 2015 2014 2013 2012. (millions of dollars) Production and manufacturing expenses 31,927 35,587 40,859 40,525 38,521 Selling, general and administrative 10,799 11,501 12,598 12,877 13,877 Depreciation and depletion 22,308 18,048 17,297 17,182 15,888 Exploration 1,467 1,523 1,669 1,976 1,840 Subtotal 66,501 66,659 72,423 72,560 70,126 ExxonMobil's share of equity company expenses 7,409 8,309 11,072 14,531 12,239 Total operating costs 73,910 74,968 83,495 87,091 82,365 (1) See Frequently Used Terms on pages 90 through 93 of ExxonMobil's 2016 Financial & Operating Review.

2016 2015 2014 2013 2012. (millions of cubic feet per day) United States 3,843 3,929 4,312 4,424 4,816 Canada/South America 198 217 276 377 407 Europe 4,192 4,473 4,847 5,474 5,727 Africa 7 5 4 6 17 Asia 3,165 3,395 3,461 3,706 3,865 Australia/Oceania 837 664 473 360 370 Total worldwide 12,242 12,683 13,373 14,347 15,202 (1) Natural gas sales include 100 percent of the sales of ExxonMobil and majority-owned affiliates and ExxonMobil's ownership of sales by companies owned 50 percent or less. Numbers include sales of gas purchased from third parties. 2016 2015 2014 2013 2012. (net wells drilled) Productive Exploratory (2) 5 7 11 16 16 Development 503 1,189 1,315 1,373 1,310 Total 508 1,196 1,326 1,389 1,326 Dry Exploratory (2) 2 5 7 8 8 Development 4 9 11 8 8 Total 6 14 18 16 16 Net Wells Drilled Exploratory (2) 7 12 18 24 24 Development 507 1,198 1,326 1,381 1,318 Total 514 1,210 1,344 1,405 1,342 (1) A regional breakout of this data is included on pages 11 and 12 of ExxonMobil's 2016 Form 10-K. (2) These include near-field and appraisal wells classified as exploratory for SEC reporting. 2016 2015 2014 2013 2012.

Arizona Freeway 101 202 And 60

(million barrels of oil or billion cubic feet of gas, unless noted) Non-U.S. The revenue, cost, and earnings data are shown both on a total dollar and a unit basis, and are inclusive of non-consolidated and Canadian oil sands operations.